All gain, no pain

Company Incorporation Service in Singapore

All-in-one service: Incorporation, Corporate Secretary, Business Account, Accounting and Tax — trusted by 10,000+ entrepreneurs worldwide.

Expert guidance on Singapore regulations

All essential services handled in one place

Licensed and regulated by the Monetary Authority of Singapore (MAS)

Clear & Straightforward Pricing

Prices include government fees for your first year of operations.

Incorporation Services

- Incorporation Filing with the Accounting and Corporate Regulatory Authority (”ACRA”)

- Certificate of Incorporation

- Business Profile

- Company Chop

- Constitution of the Company

- Preparation of pre-incorporation documents

- Preparation of post-incorporation documents

- Provision of a Local Nominee Director (1 FYE)

Nominee Director

- A Singaporean Director appointed to fulfil regulatory requirements (1 FYE) Annual Renewal

Company Secretary Services

- Provision of Company Secretarial services (1 FYE)

- Annual Return Filing with ACRA for each calendar year

- To hold AGM 6 months after the end of each Financial Year End (”FYE”) and to file the Annual Return 1 month after holding the AGM

- Maintenance of the statutory records

- Preparation of Annual General Meeting (”AGM”) documents

- All of your statutory records and compliance documents all in one place, accessible online 24/7

Registered Address in Singapore

- Registered address (1 FYE)

- Scanning and forwarding of mail

Everything included:

Your company up and running in 5 days!

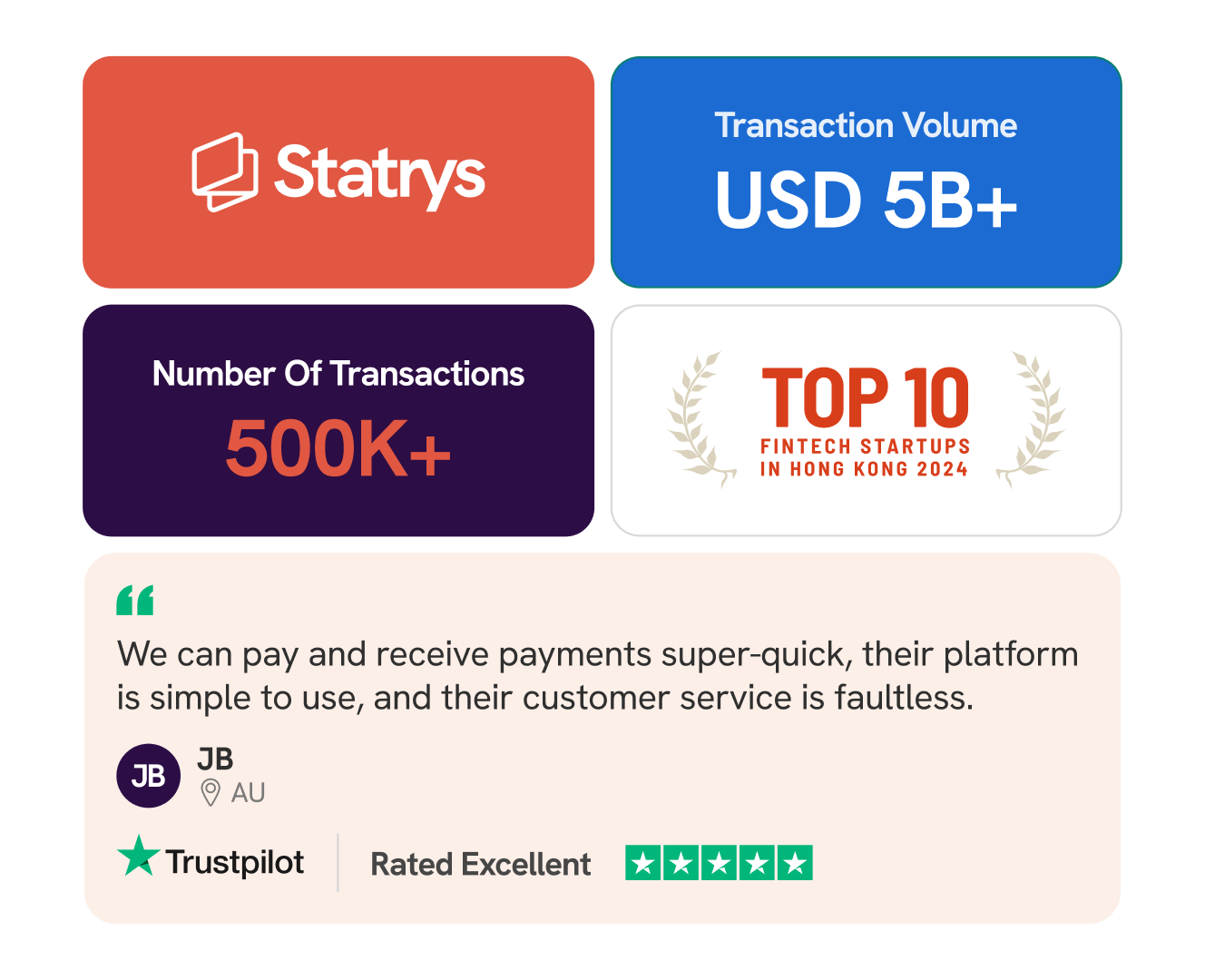

Why Choose Statrys?

Zero Risk

We will refund our fees if you are not satisfied with our service within the first 30 days.

Business Account

Made Easy

Equip your company with a Statrys business account built to support your needs.

Account name matching your company name

One account, 11 currencies (HKD, USD, EUR, CNY, SGD, JPY, GBP,CHF, AUD, NZD, CAD)

Send and receive payments in over 100 countries.

Competitive transfer fees and FX rates.

Your own dedicated account manager.

Pay-Per-Use Accounting

We provide fair accounting prices based on transactions.

You won’t pay more than what you use!!

We align with your work

Accounting & Tax services are charged based on the number of transactions you perform - In other words, it is in accordance with the actual number of transactions processed. So costs are tied to the volume of work required, regardless of the dollar-value that is transacted.Transparency & Predictability:

Transaction-based fees provide clarity for both client and Statrys.Scalability and Flexibility:

Our pricing adjusts as a business grows or contracts. An increase in transactions means a rise in cost that matches this increased workload. If activity drops, so do the fees. This flexibility means clients only pay for what they use, which is especially beneficial for startups or seasonal businesses with fluctuating activities.

4 steps to start your business in Singapore

Apply with us online for your company registration

Quick 5-minute application - Just give us the details needed to meet Singapore's local company registration laws.

We prepare the necessary documents and send them to you for electronic signature.

Get started here

Submission of the application

We submit the application documents to the Accounting and Corporate Regulatory Authority (”ACRA”).

We actively monitor progress to ensure timely processing.

Your company is registered! 🎉

We gather all the official documents confirming the registration of your new Singapore company.

This includes the Certificate of Incorporation and the Business Profile from ACRA.

Save money on your accounting

Tell us your accounting needs, and we'll get price quotes from various Singapore accounting firms for you. Pick the one that best fits your budget.

Requirements for Foreigners

At Statrys, we make it much easier for foreign entrepreneurs to comply and set up a 100% foreign-owned company in Singapore from abroad. Based on Singapore’s regulations, it is mandatory for every foreign-owned company to understand and meet the following:

Resident Director

Singapore law requires at least one director who is a local resident (Singapore Citizen, Permanent Resident, or eligible work pass holder). If you don’t have local ties, we provide a Nominee Director to meet this requirement and keep your company compliant.

Local Registered Address

Every company must have a physical address in Singapore for official correspondence. Our register office address comes with a virtual mailroom service where we’ll scan & upload your mail onto our portal.

Filing Agent

As a foreigner, you cannot file incorporation documents directly with BizFile+. Statrys acts as your licensed filing agent, handling the entire process on your behalf.

Remote KYC (Know Your Customer) Verification

Every business owner must undergo the process of identity verification, which is designed to prevent fraud, identity theft, and money laundering in regulated industries. Our onboarding and verification are done online, so you can be anywhere in the world.

Why Register a Company in Singapore?

Strategic Location & Connectivity

At the heart of Southeast Asia, Singapore provides direct access to ASEAN and Asia-Pacific markets. With political stability, a transparent legal framework, and world-class connectivity, it’s a reliable base for regional and global operations.

Business-Friendly Tax System

Singapore has one of the region’s most competitive tax regimes. The corporate tax rate is capped at 17%, with exemptions that reduce the effective rate for startups, including 75% off the first SGD 100,000 of chargeable income for the first three years.

Fast & Simple Setup

Company registration is fully online via BizFile+, with most applications approved within 1–3 working days. In regulated industries, approvals may take longer, but for most businesses it’s a fast, streamlined process.

Skilled Workforce & Pro-Business Ecosystem

Singapore combines a highly skilled workforce with strong digital infrastructure and active government support for innovation. This pro-business ecosystem makes it easier for companies to scale and compete internationally.

What Our Clients Say

They are on time with promised schedules...

They are on time with promised schedules. Nestor is my account manager and super helpful during the process. Thanks again for the service.

EXPRESS STUDY SOLUTION LIMITED

TH

The best way to incorporate in HK with a bank account

I have been very pleasantly surprised by the experience as a whole. Everyone I have communicated with has been polite, responded quickly and every issue solved in a short amount of time. The app and website work seamlessly. All around a great product that I have already recommended to friends.

Ken H.

TH

Fantastic service from Michelle in...

Fantastic service from Michelle in Singapore and Nestor for Hong Kong. Were able to get my new Singapore company set up with in 2 days. Highly responsive and quick for any questions I asked.

Robert King

SG

Very professional and high quality...

My experience with the company creation team, the first step in opening my business account, was fantastic. I talked with several people and all of them were polite and professional. Nestor went above and beyond from day one to the approval of the account, his in-depth understanding of Hong Kong made the proccess worry-free...

Lancelot Girard

TH

Company Incorporation perfection

They helped me alot with getting my company up and running with HK. Perfect support and great help! Company Incorporation with them, haven't been easier.

Frederik Therkildsen

TH

Highly Professional Service

I used Statrys for my Company Incorporation in Hong Kong, as well as opening my Company Account. The service was very professional throughout and of absolute 5 star quality. I can't recommend it enough!

Frederik Schipper

HK

Boutique services from Statrys

We strongly suggest Statrys for the Company Incorporation Services. The easy process, outstanding customer assistance, and complete service offerings make them the ideal choice for company incorporation with peace of mind. Before we hired them, we read a lot of good reviews online, which made us feel confident in their honesty and we experienced the same during our company creation process.

Machinex Global Limited

UAE

Featured on:

Frequently Asked Questions

Check out the most frequently asked questions from our clients.

Do I need to be in Singapore to register a company?

No. Singapore allows remote incorporation. A company can be registered online through ACRA’s BizFile+ portal. Your incorporation agent can submit the application, and you do not have to travel to Singapore. After registration, Statrys can help you open a corporate bank account online.

With the help of corporate services providers like Statrys, a foreign company can handle the entire registration process online, without visiting Singapore in person.What are the basic requirements to register a company in Singapore?

You must choose a unique company name and appoint at least one resident/local director (a Singapore citizen, permanent resident or Employment/EntrePass holder). The company must have 1–50 shareholders, a local registered office that is a physical address (no P.O. boxes) accessible to the public for at least three hours during business days, and must appoint a company secretary within six months of incorporation. There is no minimum paid‑up capital — a company can be formed with S$1. You also need a company constitution and to pay ACRA’s registration fee.

Can a foreigner be the sole shareholder of a Singapore company?

Yes. Singapore’s Companies Act allows 100 % foreign shareholding. A private limited company can have between 1 and 50 shareholders, who may be individuals or corporations of any nationality. However, the company must still have at least one local resident director.

What types of companies can I register in Singapore?

The main structures are: Private Limited Company (Pte Ltd) – the most common form with limited liability and up to 50 shareholders; Sole Proprietorship – owned by one individual who is personally liable; Partnership – two or more persons sharing profits and liabilities; Limited Liability Partnership (LLP) – partners have limited liability; and Public Limited Company – can offer shares to the public. Foreign businesses may also register a subsidiary, branch or representative office.

Do I need a local registered address for my company?

Yes. All companies must have a registered office address in Singapore. It must be a physical address (P.O. boxes are not permitted) and must be accessible to the public for at least three hours during ordinary business hours. If you operate from home, you may use your residential address as the registered office under the Home Office Scheme, but approval from the Housing & Development Board (HDB) or Urban Redevelopment Authority (URA) is required. Any change of registered address must be filed with ACRA within 14 days.

What is the difference between a foreign company and a local company in Singapore?

A foreign company is an overseas entity that registers a branch office or subsidiary in Singapore, while a local company is incorporated directly under Singapore law as a separate legal entity.

Do I need a Singapore resident as a local director for Singapore company registration?

Yes, at least one company director must be a Singapore resident to fulfil statutory compliance requirements under ACRA.

What is the role of a corporate secretary in a Singapore company registration?

The corporate secretary ensures that company directors meet statutory duties, maintain records, and stay aligned with legal compliance requirements.

Register Your Company in Singapore

One package, all included.

Everything you need to get your business started.